Securing Funding Dental Management Buy-In

Funding an MBI for a dental laboratory

At Rangewell we recently arranged funding for the management buy in of a £6 million dental laboratory - which required restructuring of the business to allow the deal to take place.

Table of Contents

Getting the most appropriate type of business funding for your dental practice can mean the difference between success and failure. And getting your funding wrong could cost you more than you think, which is why it is so important speaking with funding experts who have experience in your sector.

At Rangewell we were recently approached by a team who had their business plans severely disrupted by an inability to secure the funding they needed.

Our clients were ready to arrange a management buyout of the Dental laboratory that they ran on behalf of the retiring owner. Under their control, the business had grown to deliver an EBITDA of around £1 million, and the four partners were keen to take the business further.

Funding a Management Buy-In

A management buy-in is often the preferred route for succession of thriving business, allowing an experienced management team to use their knowledge and giving the business the best prospects for the future. However, it is rare that a management team will have the funds to buy a company without external finance. Once a price has been agreed it usually requires a combination of debt and equity that is derived from the buyers, financiers and sometimes even the seller, and can be structured in a number of ways.

MBIs may be financed by a combination of funding sources:

- A buyer contribution – the management team will need to use personal funds as evidence of commitment to the transaction. Those buying in may need to raise the funds by selling off assets or getting a second mortgage on their home.

- Asset Refinance – leveraging against the assets in the company, including premises, stock and equipment, can generate a high level of funding. Using the assets of the company to buy the company itself can be a particularly effective solution for those businesses with a large investment in plant and property.

- Business Loans – business lenders may offer unsecured loans repayable over three to five years, or a larger scale of lending and a longer term with a secured loan, with the security provided by other business assets.

- Private Equity – Private Equity firms may be able to advance funding for an MBI, but may impose strict conditions. Their funding often includes stipulations about how the company must be run and may include financial and other objectives.

- Vendor Loan – the vendor can help fund the transition by leaving some of their equity in the company as a loan, which will be repaid over time.

In the case of our clients, the business had no property to act as security for the large level of funding required. This was causing problems for potential lenders who prefer the security of business property.

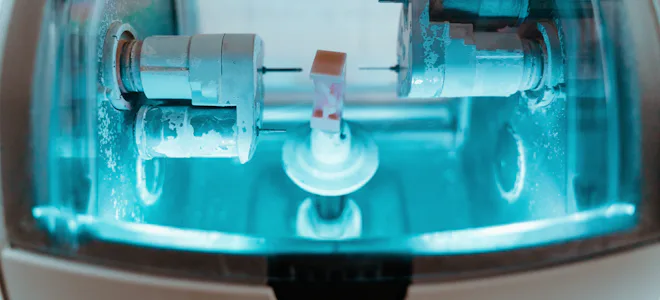

However, the business had £300,000 in stock and £500,000 in equipment, which included some of the most advanced laser dental laboratory equipment.

They asked the Rangewell team to use their skills to find a solution.

Finding a solution

Our first step was to recognise that ‘jigsaw’ finance would be required. The sums involved were too high for a single lender and a single type of finance. Rangewell put together a package made up of funding from various sources, and negotiated on behalf of our clients.

- Step 1: to secure a loan of £3.3million based on the excellent EBITDA of the laboratory

- Step 2: this would need to be supported by a cash contribution totaling £300,000 from the management team. We helped arrange loans secured on the partner’s properties where required.

- Step 3: we discussed the offer with the vendor and agreed on a deferred payment of £2.4million on an ‘earn-out’ basis over the next five years. This would mean substantial tax advantages for the vendor.

Arranging this type of complex solution is impossible going direct to a lender. By coming to Rangewell, it was possible to arrange the type of jigsaw deal required.

Why you need Rangewell to find finance for your buy-in

If you are ready to buy into an established practice or business, many lenders will be happy to lend. A management buy-in can be a relatively low risk because it is based on a business which can demonstrate dependable performance and will have the potential to do even more when the managment team are also the owners.

But not all lenders will be prepared to offer the most competitive terms or the flexibility that you require - and none can offer you the pick of the entire lending market to help ensure that you get the deal thats right for you, with the rates and terms you want.

Looking for the most competitive deal across the entire market takes time and expertise. At Rangewell, we work to find the lenders who can offer the most competitive rates for you, and find solutions for all types of dental practice finance.

We understand the challenges of MBIs, and the solutions to them. We can help source the entire range of conventional loan products, and Alternative Funding from new loan providers and styles of funding. Even more important when it is an MBI, we can work with you to tailor the kind of complicated ‘Jigsaw’ Funding plan required to support your plans.