What’s the difference between cash and profit

Table of Contents

If you are running a business, you need to understand some key terms. And two of the most important are profit and cash.

The terms cash and profit are superficially familiar, but they have very different meanings in the world of business.

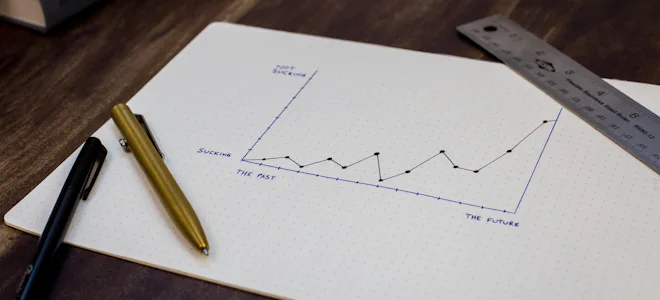

Profit and cash flow are both important elements of a healthy, growing business, but they are not the same thing. Just because a business is profitable - with work coming in and goods or services going out - doesn’t mean it’s generating sufficient cash flow to operate, grow or even sustain itself.

In extreme cases, bringing in more work can actually mean a business is worse off.

To manage your business successfully, you need to understand the difference between making money - profit - and managing money - maintaining your cashflow.

Why profit and cash flow are different

Profit may also be referred to as net income, and can be defined as revenue less expenses.

Cash flow, on the other hand, refers to the money coming in and the money going out for a particular business. It is more complicated than income. Earning revenue does not always bring in cash immediately, and incurring an expense does not always mean that you need to pay out cash immediately.

So, if you make widgets, you may sell them to retailers.

Sell a £300 widget on the first of July and you can email an invoice – but the retailer won’t pay until the beginning of August.

You might make a profit - £50 if the widget only cost you £250 to produce. But you will have a £250 expense to cover, and a month to wait for your payment. You have a £50 profit to look forward to, but a cashflow minus of £250 to cover. Without that payment, you have no way to pay staff who made the widget, the suppliers who made the parts to assemble it, or the landlord, or the electricity company – the list of overheads goes on and on.

Of course there are solutions. Cash collections from your sales in prior months could provide cash to let you make and deliver products. Sales in April and May could help cover the shortfall in June – but if your sales are on the up, your previous month's sales may not provide sufficient revenue to cover them.

It means that a big, profitable order could actually drive your business under, because you would not have sufficient cashflow to produce it, or stay in business until you were paid.

You might be able to delay cash payments. Some suppliers may be prepared to wait for payments – but others, like the taxman, won’t.

You may need to raise additional capital. Businesses can raise capital by issuing stock, which means that an investor buys part of the company in exchange for cash. Selling a percentage of your company means losing out on the future profits as well as losing control of your business.

Another possibility is to take out a business loan. Borrowing requires the company to make interest payments on debt, and repay the original principal amount borrowed on time. It could actually make your cashflow problems worse, with monthly repayments added to your outgoings.

Invoice Finance could provide the solution

Cashflow is made much more of a problem if you are waiting to be paid. In some sectors, waiting up to 120 days for an invoice to be paid can be the norm - which places intolerable burdens on your profitability.

Invoice Financing provides an ongoing credit facility that protects you against late payment – because it ensures you get paid fast even when customers are slow.

It could let you take up to 90% of the income, including your profits tied up in your unpaid invoices immediately, with the remainder paid to you, minus fees, once the customer settles the outstanding balance.

There are several types of Invoice Finance, and which may be suitable for you will depend on the nature and size of your business.

Solutions for retailers

Of course, if your customers are other business, your challenges are slightly different. Cashflow will still be crucial - but you may have a steady stream of income and profit that comes in with every sale you make - and still suffer a cashflow crisis.

This can happen if you need to deal with high costs - from the annual tax bills to the monthly landlord’s demand - to the need to replenish your stock.

Here, a solution like a Merchant Cash Account - essentially an advance on your credit card takings - can provide the cash injection your business needs.

Getting the answer that’s right for you

At Rangewell, our team of business finance experts work with you to get to know your business and understand the kind of arrangement and features you need. They can help you find lenders who work in your sector and secure the most competitive deal to upport your cashflow, complete with any extra services – such as bad debt cover – that you require.

To find out more about working in partnership with Rangewell to find better answers to your budget and forecast needs call us. Our service is free.