How can Construction Finance support your business?

What you need to know

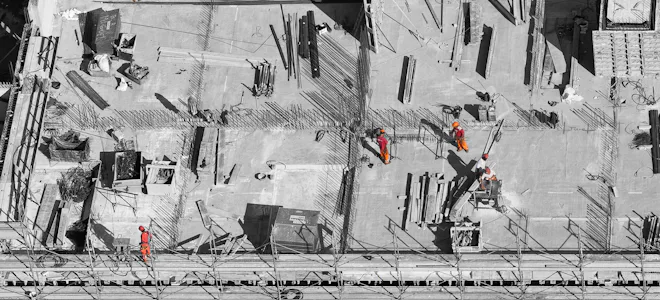

Costs are always high in construction, but Construction Finance can help manage those costs so cashflow is never a problem.

Table of Contents

Due to the rising demand for housing and commercial locations, the UK construction industry continues to be a thriving sector. However, construction can be a challenging environment, with one of the common issues usually involving the matter of funding. Whether you’re a small firm or well-established, running out of money during key projects or being unable to prepare in time for new contracts is often a genuine concern. However, the means to support your business and from the challenges of this sector could be closer than you think. For many construction firms, applying for Construction Finance is the answer, offering companies access to a variety of finance solutions. So if you work in the construction industry and need access to additional capital, here are some of the ways in which applying for Construction Finance could help.

Supporting the burden of late payments

For any construction firm, the pressure created by late or unpredictable payments from clients can be immense. Yet unfortunately, this is often a common occurrence in the construction industry and one that can easily lead to any number of other issues, such as delays, rising project costs and the inability to accept new contracts. However, by exploring what Construction Finance has to offer, you could release the capital contained within your unpaid business-to-business (B2B) invoices by applying for Invoice Finance.

Invoice Finance uses the capital within your unpaid invoices worth in excess of £5,000, to release up to 90% of the funds that you’re owed. There are two types - Factoring or Discounting - and the good news is that an Invoice Finance agreement could be established in as little 48 hours (depending on the complexity of the request), making it a swift way to ease the pressure of late payments.

Resolving contractor and subcontractor wages

Another area that many construction firms face difficulty with often involves paying contractor and subcontractor wages on time. During each project, there are often several aspects that all need funding. But since construction projects are usually handled in stages, making sure that you have enough capital set aside to pay your team at the end of each phase can pose an issue. Being unable to support your staff could bring the project to a halt, leading to delays and rising costs. Yet, as well as Invoice Finance, Construction Finance also offers you access to Overdraft Replacement.

Overdraft Replacement is another way of raising capital by granting you instant access to an allowance based upon your previous income, once an agreement has been established. Plus, much like a credit card facility, you’re under no obligation make use of the allowance but anything you do withdraw is charged interest and will need to be fully repaid within 30-90 days (depending on your agreement). Subject to little or no usage restrictions, Overdraft Replacement can be an invaluable tool for settling staff wages or supporting any other aspect of the project.

Replenishing building materials

Finally, whether you’re in the middle of an existing project or are hoping to acquire another contract, having access to the building materials you need is vital. However, acquiring or replenishing these can prove a difficult challenge to overcome and, without them at your disposal, completing any given project will become an uphill struggle, leading, again, to expensive delays. So by applying for Construction Finance, you could gain access to the capital you need to maintain sufficient stock levels at every stage of the project, enabling you to move past this issue and succeed in total confidence.

Thinking about applying for construction finance?

Like any business operating in the UK, having access to enough capital is a crucial element of running a successful business in the construction industry. However, because of the many challenges that may arise, making sure that you have enough capital available at every stage of the project isn’t easy, highlighting the need for stringent financial planning. But one way in which many construction firms get around these issues is by applying for Construction Finance. All you need to do is source an appropriate finance agreement from a lender you can trust, which is where we can help.

At Rangewell, we’re an Access to Finance specialist who’s mapped over 400 lenders to offer you an overview of more than 23,000 business finance products. Our services are free to use and we’ll also guide you through the application process. So if you are looking to finance construction, apply or find out more with Rangewell.