Funding to buy a second accountancy firm

Table of Contents

Getting many types of business funding is proving more difficult in the wake of Covid. When that funding is required to provide the cash for an ambitious business purchase, the challenges are made much more severe - especially if the business looking for funding was experiencing a downturn even before the crisis hit. At Rangewell, we recently arranged funding to allow an accountant to buy another business - and overcame the challenges caused by high gearing to secure funding at a competitive rate.

There are three factors that make this type of funding more particularly challenging:

- Lenders are concerned about the ongoing impact of Covid on the economy and may have tightened their lending rules

- Lenders are always reluctant to provide funding when they believe the applicant is operating a business with problems

- Government help for businesses during the Covid crisis can be generous - but CBILS and Bounce Back Loans are explicitly ruled out for businesses with existing trading difficulties

At Rangewell, we were recently approached by a client running an accountancy practice which had their business recovery plans severely disrupted by an inability to secure the funding they needed.

Buying an accountancy practice

Acquisition of a competitor is one of the main routes for developing an accountancy practice. Although there can be no guarantee of any kind that the clients of the business being purchase will stay with the new practice, it can allow for rapid growth in the scale of the practice doing the purchase.

The purchase of the goodwill alone, rather than premises or other assets, is the norm in this sector.

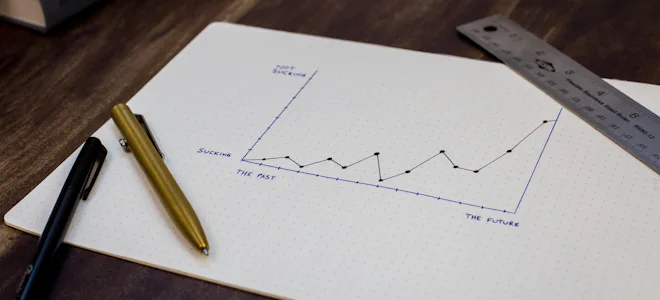

The business was successful but had reduced the turnover in recent years because of the declining health of the previous owner. The new owner had taken over the practice, understanding that it had declined, but was starting to put it back onto a growth course.

“The practice had lost some key clients, but we were still profitable and I was confident that I would be able to turn the business around. But I needed some new business quickly. The simplest way to do that would be to buy the goodwill of an existing firm - and I found one that would be ideal.”

The retiring accountant had agreed that a sum of £150,000 would be appropriate for the goodwill built up in his practice.

A professional accountant with a practice of their own should be able to arrange a loan of this scale to take over a business without difficulty. Banks and other lenders will see the profession as a good business risk and be happy to offer funding on attractive terms.

However, the practice was already close to its credit limit with its bank and, with the problems the broader economy had been experiencing, the bank would not provide any further funding.

“I wanted to put the business back on a professional footing. It was frustrating that the bank could not help.”

The accountant had called on us at Rangewell to provide funding for clients - so it seemed logical to call on our expertise to find a solution to his own needs.

We looked at the problems and saw that the influx of new business would be valuable but the combination of Covid, the downturn in the existing business and the fact that it had reached the credit limit with their existing bank was causing problems.

“I had taken on a business in a downturn - but I could not raise the cash I needed to start it heading back up.”

The funding solution Rangewell arranged

As the owners of an accountancy practice that was established and had been able to show a record of profits in the past, it would usually be simple to arrange funding. Banks and other lenders will usually see accountants as ‘safe’ choices for funding.

However, the fact that the practice was already highly geared meant that it was impossible to secure additional funding for our client. He had used all available credit to buy the business and to keep it afloat.

We knew that in these circumstances it would be possible to arrange funding for a specialist in distressed lending - which could provide funds at a high rate of interest.

We discussed this with the client and agreed that this would be possible - but that the high cost of this type of credit would put the business itself at risk.

The client had become a high-risk proposition for lenders because of the amount of credit that was already being used. The problem was that their available credit was all in use, and that was obvious to new lenders, who saw the business as being in distress.

However, we saw that the solution would be to provide additional credit for the short term, which would improve the trading position of the business - and so make it suitable for the large-scale loan required for the business purchase.

We arranged two funding streams - one for £20,000 as a Revolving Credit arrangement, and an additional £30,000 facility using business credit cards.

This provided an additional £50,000 worth of credit that the accountant could call on as required.

But it would have another even more important effect. With additional credit to call on, the practice was no longer trading at a disadvantage. It would mean that much lower rates for the business purchase loan could be negotiated.

Together the two credit lines would be more than enough to give the incoming owner a cash reserve to deal with any problems with cashflow while he continued his work of revitalising the business - and provide evidence of sufficient credit to enable a lender to provide the funds required for the practice purchase.

How can we help you?

If you are faced with a funding problem, and especially if your bank cannot help provide the funds you need, the answer is to call us at Rangewell. We are experts in all aspect of business funding and we can use our knowledge to find funding solutions - when going direct to lenders will only mean problems.

To find out more, call Rangewell for an informal discussion on 020 3318 2613 or email contact@rangewell.com.