Capitalising on Sudden Stock Opportunities With Ecommerce Finance

When an ecommerce retailer’s main competitor decided to quit, the opportunity to buy stock was too good to miss - but the retailer needed ecommerce finance to afford it

Read more in this case study.

Table of Contents

Competition is rife in the world of ecommerce. Every sector of ecommerce, from clothing to gardening, face direct competitors and indirect pressure from multi-sector ecommerce stores and third-party retailers. As ecommerce surges in popularity, it is now easier than ever for a business to set up and get selling - which means it’s harder to maintain a competitive advantage if you’re an existing business.

When a successful cycling garment retailer was presented with an unbeatable opportunity, they approached Rangewell’s ecommerce experts for help. Their main competitor was exiting the cycling sector market and moving into new niches, which left a huge level of their current unsold stock up for grabs. After negotiating with the departing business, our client was offered an unmissable discount if they could purchase the entirety of the stock in one go.

Unfortunately, that full asking price was around £85,000 - which our client did not have due to cash flow issues and seasonal sales lead times. However, the normal wholesale value of the stock was £150,000 - so our client knew they would return generous profits if they could buy it all at the offered asking price.

To do this, they needed an injection of cash that would support the stock purchase and even accommodate for storage costs. When they explained the situation to our team, we were happy to step in and start looking for the right lenders.

Why Rangewell were able to help

Our finance experts are constantly communicating with ecommerce lenders across Europe, who are always interested in finding new customers who they can support. The criteria for finance and eligibility always differs between lender, but they all value businesses that can show strong growth potential and sales forecasts.

In this instance, our client was already running a successful business - but like many ecommerce retailers, cash flow was tied to the purchasing of stock and marketing - with revenue reinvested into the business to fund more stock purchases and growth.

Recognising this, we shortlisted lenders who we knew had an interest in this size of business and were interested in the opportunity. Our client needed a loan of £85,000 and they needed it quickly - they simply couldn’t afford to leave their old competitor waiting as they might choose to sell elsewhere.

We negotiated between our client and the lenders to facilitate the deal. In the end, our client was offered a loan for the full amount with generous repayment terms that allowed the client to spread the cost over a longer time period. Once the stock was bought and the client’s competitor had exited the market, a new influx of customers and purchases meant repayment could be easily maintained even as they grew.

About ecommerce finance for inventory

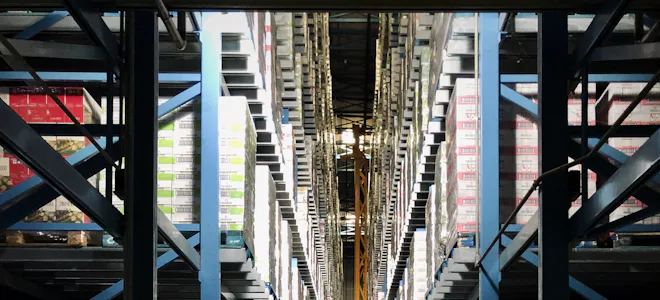

Stock is one of the most important parts of your business - after all, without it, you can’t sell. Only retailers with great customer service and brand loyalty can ‘afford’ to let stock levels slip, as customers who see the ‘out of stock’ sign on a site will simply switch to another site. For most ecommerce retailers, having in-stock items is crucial to making sales.

When you’re presented with an opportunity like our client was, it’s hard to say no. Purchasing a large amount of stock at a discounted rate means you know you can make a profit - provided you can afford that initial investment. Most retailers simply do not have the cash flow and capital required to achieve that, which is where ecommerce finance lenders step in.

At Rangewell, we work with these lenders and our clients to create finance agreements that help ecommerce businesses thrive. We negotiate between our client’s requirements and the lender’s expectations, delivering finance options that help support growth. By carefully considering repayment length and terms, we ensure that any deal won’t hamstring your business.

Contact us today if you’ve got a stock opportunity you’d like to invest in. We’re always happy to help and offer a no-obligation consultation for ecommerce businesses of all types.