Why a Bridging Loan is the best option for your business

Table of Contents

Cash has always been a vital resource in business, but ensuring that you have access to sufficient amounts can be tricky. This is especially true when dealing with issues regarding real estate, which typically carries a high retail value. But this is where Bridging Loans can help. Bridging Loans are secured business finance products that can help you borrow large lump sums for all matters involving property. So, if you wish to expand your portfolio or carry out vital redevelopment projects, here’s why you should consider applying for a Bridging Loan:

- Suitable for a wide range of purposes

- Access to large Lumps sums

- Flexible criteria

- Choice of products

- Range of repayment methods

What can a Bridging Loan be used for?

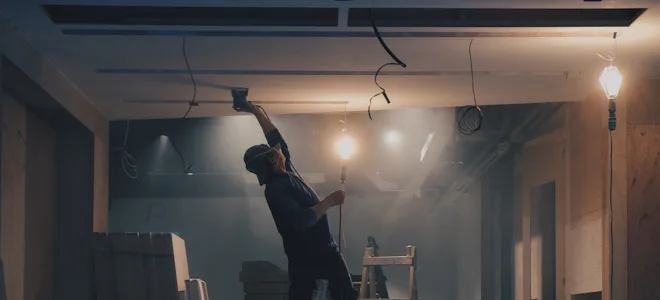

What makes Bridging Loans such a useful resource for your business is that they can be used to provide funds for a wide range of purposes relating to real estate. So, as well as supporting the purchase of property or land, Bridging Loans can also be used to carry out refurbishments and renovations that will add value to your portfolio. Note that Bridging Loans will require the property relevant to the agreement to be used as collateral. Nevertheless, Bridging Loans offer you the means to reinforce your presence in your local area or across the UK, ensuring your business’ long-term sustainability.

How much can I borrow?

By applying for a Bridging Loan you could gain access to a large lump sum that could cover up to 80%, or possibly more, of the total cost or expenditure you’re looking to subsides. Because a potential lump sum is based on a percentage, there’s no set upper limit dictating how much your business could borrow. However, funding often starts from a minimum of £10,000, with some lenders imposing their own limits based on what they are willing, or can afford, to lend. Such limits can range from £500,000, £1,000,000 to even £10,000,000 and beyond, so you need to make sure you choose a lender that can accommodate your request.

How can I apply for a Bridging Loan?

Lenders usually take on a flexible approach when considering an application for a Bridging Loan, mainly because you’re required to provide collateral in the form of real estate. Regardless of whether it’s used commercially or provides residential accommodation, you present any property or piece of land that you own outright to gain the attention of potential lenders. Plus, if you wish to increase your chances further, you can also use more than one property as collateral.

Although lenders may ask to review your business’ credit profile, possessing a weak credit score usually isn’t used against you. Because you’re providing collateral, in the form of property or land, there is less risk for the lender. However, providing this will allow lenders to gain a stronger insight into your current financial situation, any existing debts and business performance. Also, your credit score can affect the rate of interest that you’re offered. Lenders typically have a range of interest rates available, but the rate that you’re presented with is determined by the strength of your credit score.

In addition, lenders will also require you to set out an exit strategy making clear how you intend to repay the loan. Will you be using the proceeds from a property sale? Is the project you’re looking to fund going to generate the necessary capital? Or, will you be using another business finance product to procure cash? However you aim to repay the loan, lenders will need to know before they can even consider offering your business an agreement.

What products can I choose from?

Another aspect that makes Bridging Finance so useful for your business is that you have a choice of Bridging Loan products to choose from. Depending on affordability and how you intend to raise the necessary capital for making repayments, you’re able to apply for either a Closed Bridge or an Open Bridge. However, to make an informed decision and know which product suits your business’ needs, understanding how both of these finance solutions work is essential.

- Closed Bridge: requires you to fully repay the Bridging Loan by a set date, usually within an agreed term that could extend up to 12 months. Therefore, this type of Bridging Loan would be suitable if you’re buying and selling property and have agreed a completion date.

- Open Bridge: doesn’t tie you down to a specific date but, instead, allows you to fully repay the loan as soon as you’re ready. However, lenders usually specify a cut-off period informing you of exactly how long they’re prepared to wait. This is typically anywhere within an agreed term, which could last up to 12 months. As such, this type of loan could be suitable for business projects that have no set completion date.

How are Bridging Loans repaid?

Bridging Loans are secured short-term business finance solutions with terms that typically last up to 12 months and sometimes 18 months if you’re using an unregulated lender. But, because Bridging Loans carry a high interest rate, using this as a short-term solution rather than long-term is more cost-effective. Plus, if you’re able to, you can repay a Bridging Loan early in order to save your business more money. Nevertheless, you still need to consider how you intend to handle the interest as well as the money that you’ve borrowed. To do so, you usually have 3 repayment schemes to choose from: Pay Monthly, Rolled-Up Interest and Retained Interest.

- Pay Monthly: enables you to make monthly interest payments to the lender until you’re able to fully repay the principal (or money borrowed).

- Rolled Up Interest: involves taking all the interest that you’ve incurred throughout the agreement and adds it together with the money that you’ve borrowed for a final payment. As such this means making a larger repayment at the end of the agreement.

- Retained Interest: this option allows you to borrow the interest that you’ll incur for an agreed number of months, as well as the money that you’re requesting to loan. Although the lender keeps the retained interest, this money is used to help you make monthly interest payments until the principal has been fully repaid. If you haven’t used up all of the retained interest by the end of the agreement, lenders may reimburse whatever is left back to your business.

Can’t afford to wait any longer for a lump sum for your business?

For your vision to turn from idea to reality, you need access to sufficient amounts of cash. Although looking around for business finance be arduous and frustrating, finding a suitable product at a competitive rate can also be highly rewarding. If your business needs access to a large lump sum and fast, there are plenty of business finance products available, including Bridging Loans. We can even look at re-bridging an existing bridging loan. With a with Bridging Loan, you could borrow up to 80% or more of the total cost or expenditure you’re looking to cover. The only challenge now is knowing who to borrow from. Thankfully, we’ve already done the hard work for you. If you’re looking for cash and the need the money as soon as possible, apply for Bridging Finance today, or find out more with Rangewell.