The not so secret secrets to cash flow management

Table of Contents

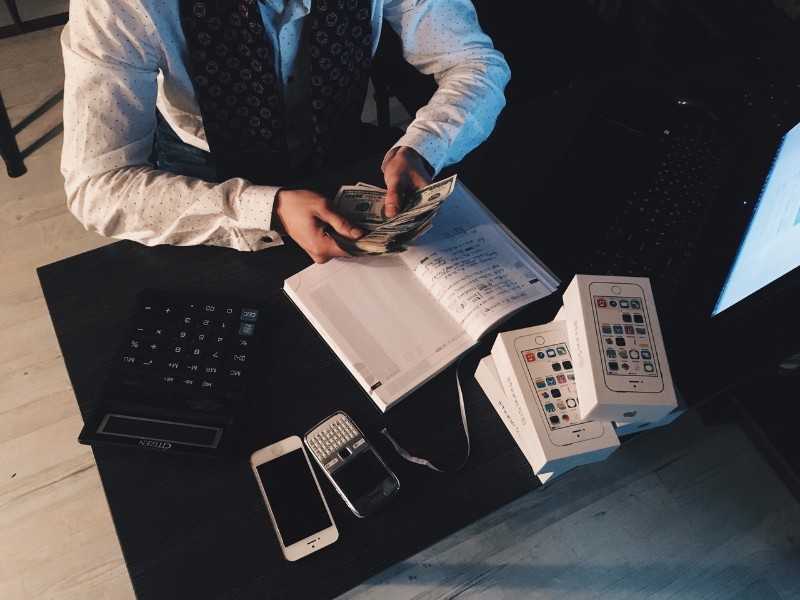

In business, survival depends upon one essential ingredient – cash flow. Without it, we wouldn’t be able to produce and deliver the goods and services that we offer daily. This is why careful nurturing of your cash flow is so essential, subjecting it to intense observation and scrutiny. Yet, however, business can be a harsh beast to tame and sometimes even the most robust establishments can fail. In order to survive and prosper close management of your cash flow is a necessity you can’t shirk.

Cash Flow Management

Severe cash flow issues can lead to the death of any business, large or small. Only through managing your cash flow effectively can your business pull through and reach a brighter future. Yet, to offer you some sound advice that can make all the difference, we at Rangewell have put together these 5 essential ways to help you take back control of your cash flow.

1. Credit Control

Credit control is an absolute must for every business. You need to know how much you’re spending, how much money is in your business account, how much money you owe and, most importantly, how much your customers owe you.

For small business owners especially, conducting credit control checks can be an issue, often lacking sufficient time and the necessary funds to hire someone to do it on their behalf. However, some choose to ignore unpaid bills, fearing that they’ll lose customers if they pursue it. Yet if your customers aren’t paying for the goods and services they’ve received, your cash flow is taking the blow instead. You may be tempted to brush them off as small sums but over time they accumulate, becoming much more costly.

2. Recovery

If you are going to pursue the debt, there are more cost-effective ways of going about it. Rather than let it get to the stage where you’re taking them to court, send out reminders 3 days before payment is due either via letter, email or text. However, once the due date has passed and no payment has been transferred, it’s time to up your tone. This time you are not asking or requesting, you’re demanding that the payment is made. Give the customer a call or send a letter, but be firm. Let them know that if the payment is left unresolved you fully intend to pursue it through the courts if needs be. Besides, reluctance never gets you anywhere.

3. Profit and Cost

For many growing businesses the main risk to your cash flow can come from uncontrolled spending. Your revenue is a precious commodity. When you find that your business is unnecessarily losing money on account of frivolous expenses, your revenue disappears. One method of challenging this is by keeping a constant watch on your expenses. At the end of each month conduct a review and ask yourself, “Was that item or service truly necessary?” If the answer is no, you’ve lost money and must learn from the mistake in the future.

Another option is adjusting your pricing, though this can easily upset and annoy your customers. If your business is suffering cash flow issues you may have no choice but to raise them but keep any changes marginal or you’ll see your once-loyal customers heading to your competitors instead. The same applies the other way, reduce your profit margin too much and your profitability ceases, along with your cash flow. Getting the right balance in your pricing can be tricky, but must be resolved.

4. Negotiate with suppliers

If you don’t ask you don’t get and that’s absolutely true in business. If you feel that the cost of supplies could be lower, get in contact with your suppliers. Ask them if there is a better package available to you but if you’ve got a strong relationship with them why not use that to your advantage? Press for lower prices or some additional extras, express that if they don’t employ some wriggle room you’ll go with their competitors instead. Negotiating can be hard for some business owners but just remain steadfast in your resolve and you never know what you might get.

5. Alternative Finance

Finance is an extremely useful tool for business owners. If you need quick cash to support your business, the alternative finance industry can definitely help. Founded in the aftermath of the UK Banking Crisis, this exciting and rapidly growing industry is offering business owners thousands upon thousands of diverse finance packages to suit their every need. If you’re having trouble supporting your cash flow there are options available, including Business Loans, Invoice Finance and Revolving Credit Facilities.

- Business Loans: Typically secured or unsecured, business loans are an excellent way of acquiring a lump sum, applicable in however you see fit. With both products, you will be required to comply with a monthly repayment scheme, plus interest. Applying for an unsecured loan lets you borrow anything from £5,000 to £250,000 without the need to set aside assets. Meanwhile, secured loans help you acquire larger sums ranging from £5,000 to as much as £1,000,000. In exchange, lenders will require you to set down assets as security.

- Invoice Factoring: With Invoice Factoring, you could receive a lump sum based on a percentage of your outstanding invoices. This is usually used as a means of support whilst you await payment from your customer. Until the customer pays you in full or begins making instalments, you won’t be required to repay your finance provider. However, that said, your provider will set down a term and once that period passes they’ll expect repayment, regardless of whether the invoice has been paid or not. The repayment usually consists of a monthly repayment scheme plus interest and any service costs.

- Invoice Discounting: Another great method for getting what’s owed to your business is through Invoice Discounting, which essentially accelerates the cash flow recovered from your customers. How this option works is by submitting the details of an outstanding invoice to your finance provider but, instead of the customer paying you, they pay the amount directly to your finance provider. During this time you’ll receive a lump sum, possibly within 48 hours of your initial application. But when it comes down to ensuring payment from your customer is forthcoming, you can either assert yourself as the credit controller or the finance company may have a ledger service that could initiate the collection process. Once the finance provider has received the funds from your customer a balance is made available to your business, minus any incurred fees.

- Revolving Credit Facility: A Revolving Credit Facility is a great way in which your business can get access to Quick Cash. This type of finance works in a similar way to a typical bank overdraft or a credit card in some ways. Each month you’ll get a pre-agreed allowance. Should you take money out, interest will be added. However, if you withdraw more than the allotted sum you’ll be charged an overdraft fee.

Why Rangewell?

Our values are simple – We’re on your side. Our services are clear and transparent. We support a wide range of SME businesses of every shape and size, for finding every type of finance. Follow us on Twitter and LinkedIn for business tips and tricks, and feel free to call us on 0203 637 2340 if you’d like to chat about what we can do for you.