Important information for Growth Street Borrowers

By Richard Mitchell

Content writer

Last update: 29 June 20201 minute read

Table of Contents

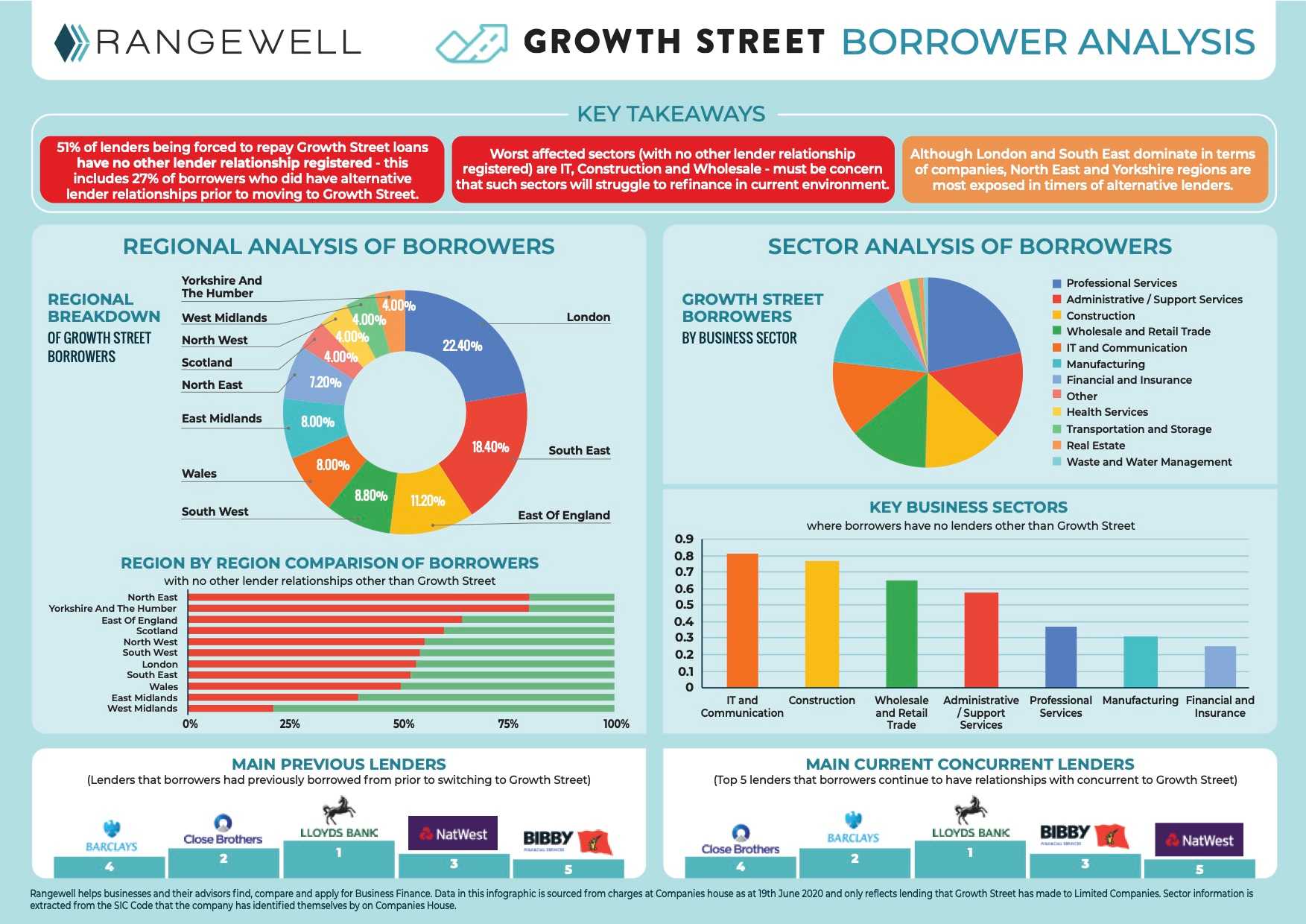

Growth Street, has issued a “Resolution Event” and has assigned all current lending to Growth Street Provision Limited.

This means that if you have borrowed money from Growth Street they will be asking you to repay your loan within the next 30 to 90 days - less than ideal given the current economic situation!

What are Rangewell doing to help?

- Rangewell have formed the Growth Street Borrower Action Group and are already working with many affected borrowers. We’re also in contact with numerous lenders who we work with on a regular basis who are keen to engage with Growth Street borrowers.

- Rangewell’s services are free, fast and efficient - we’re all ex-bankers who know the questions lenders ask and the answers they want to hear.

- Rangewell has a large and well-resourced team of finance specialists that continues to speak to lenders every day - since lockdown on the 23rd of March we’ve received offers and closed deals with 33 lenders.

- Rangewell believe we have more active lenders on our panel than anyone in the UK - we work with everyone from the High Street and Challenger Banks to the Specialist, Niche, Alternative and Private lenders.

- We know and understand the sectors most affected by Growth Street's decision to cease lending - we hope that when you speak to our sector experts you’ll see what we mean.

View high resolution image

View high resolution image