Growth Street Borrower Action Group Launched to support Borrowers

Table of Contents

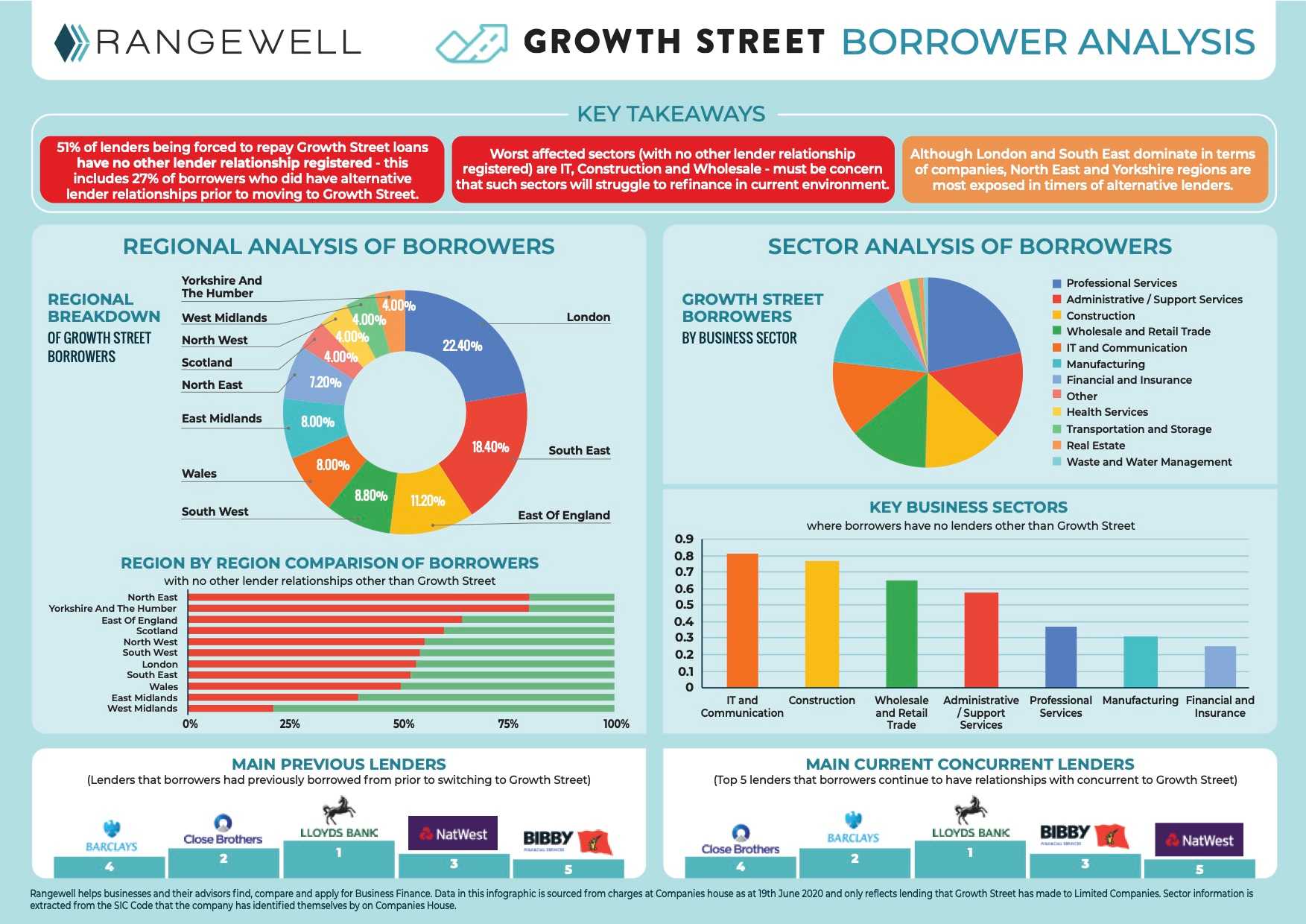

Click here to view the full analysis of Growth Street Borrowers carried out by Rangewell

Since Growth Street announced their "Resolution Event" on 15th June, many of their borrowers have been concerned and confused. To help such borrowers, Rangewell has produced this information page collating all available information and resources to help borrowers understand the situation and what the process will be.

In effect, Growth Street will be asking for their loan to be repaid within the next few months and borrowers should be making alternative arrangements.

The Growth Street Borrower Action Group has been set up by Rangewell to help support borrowers who are having to repay their Growth Street loans unexpectedly and are looking for alternative finance.

If you require support or would like to discuss your options, please contact Paolo Lepore.

Phone - 0330 808 8802

Email paul.lepore@rangewell.com

What should I be doing as a business?

Growth Street have themselves stated that

"We will work with all businesses, individually, to help them to find alternative sources of finance and to develop bespoke repayment plans to try to minimise any disruption to their day-to-day operations"

and that the recalling of the loan is

“likely to be disruptive to your business.”

We would suggest that, given the importance of maintaining external finance and the fact that Growth Street are asking for their facilities to be repaid quickly, it would be sensible to:

a) Discuss the situation with your accountant - it's important to consider the cash flow consequences of what is being requested

b) Seek external support from experts who understand the finance market and the current lending landscape - we would obviously suggest Rangewell (call us on 0330 808 8802 at any time).

What should I do if I have not been contacted by Growth Street?

We would suggest you call your contact at Growth Street as soon as possible and ask:

- For a named contact at Growth Street who will be dealing with you during the Resolution Period

- That the details of what is happening are re-posted and emailed to you as soon as possible

- For a clear timeline as to when your loan is expected to be repaid

Again, as above, we would suggest to would be appropriate to be talking to external support.

Recent Press Comment

- The Times 22nd June - Small firms given three months by Growth Street to repay loans

- P2P Finance News - Growth Street borrower action group launched

- Growth Business - Small businesses blindsided by Growth Street demanding its money back

What letter was sent to lenders?

An example of the letter that was sent to lenders is attached below:

On March 16 2020, due to insufficient liquidity on the platform, Growth Street entered a Liquidity Event for a period of 90 days under clause 7.3 of our investor terms.

We regret to inform you that the continued impact of the novel coronavirus (COVID-19) on the economic environment has prevented us from resuming normal P2P investor platform operations at the end of the 90 day period. Without the means to remedy the Liquidity Event, we are required by clause 7.7 of our investor terms to call a Resolution Event.

When considering whether the Liquidity Event could be remedied we looked at the following factors:

The stability of the landscape and wider economic climate which prompted investors’ concerns;

Whether resuming platform operations would result in significant withdrawals or settings alterations; and

Whether there was sufficient liquidity to cover the sum of previously requested withdrawals plus an additional contingency for further withdrawals

It was concluded that normal platform operations could not resume.

The benefit of all outstanding loans on our platform has been assigned to Growth Street Provision Limited. We will begin the closure of the current loan book (it being acknowledged that some borrowers may need to be given longer to repay which will extend the repayment period beyond their contractual terms).

Ensuring that money is returned fairly and equitably to investors is Growth Street’s priority. Any payments we receive from borrowers will be distributed to investors on at least a quarterly basis as per clause 6.8 of the investor terms.

We want to reaffirm that Growth Street remains an operational business whilst we enter the closure of our current loan book. We are in discussions with potential institutional debt financiers to provide a new source of liquidity to resume lending.