CBILS and Bounce Back Loans Dashboards Week 8

By Nic Conner

Head of Research

Last update: 11 August 20251 minute read

Table of Contents

Latest CBIL / Bounce Back Dashboards show many UK business are failing to meet CBILS requirements

A “Project Spruce” - replicating the forthcoming “Project Birch” for larger companies - is needed for smaller companies

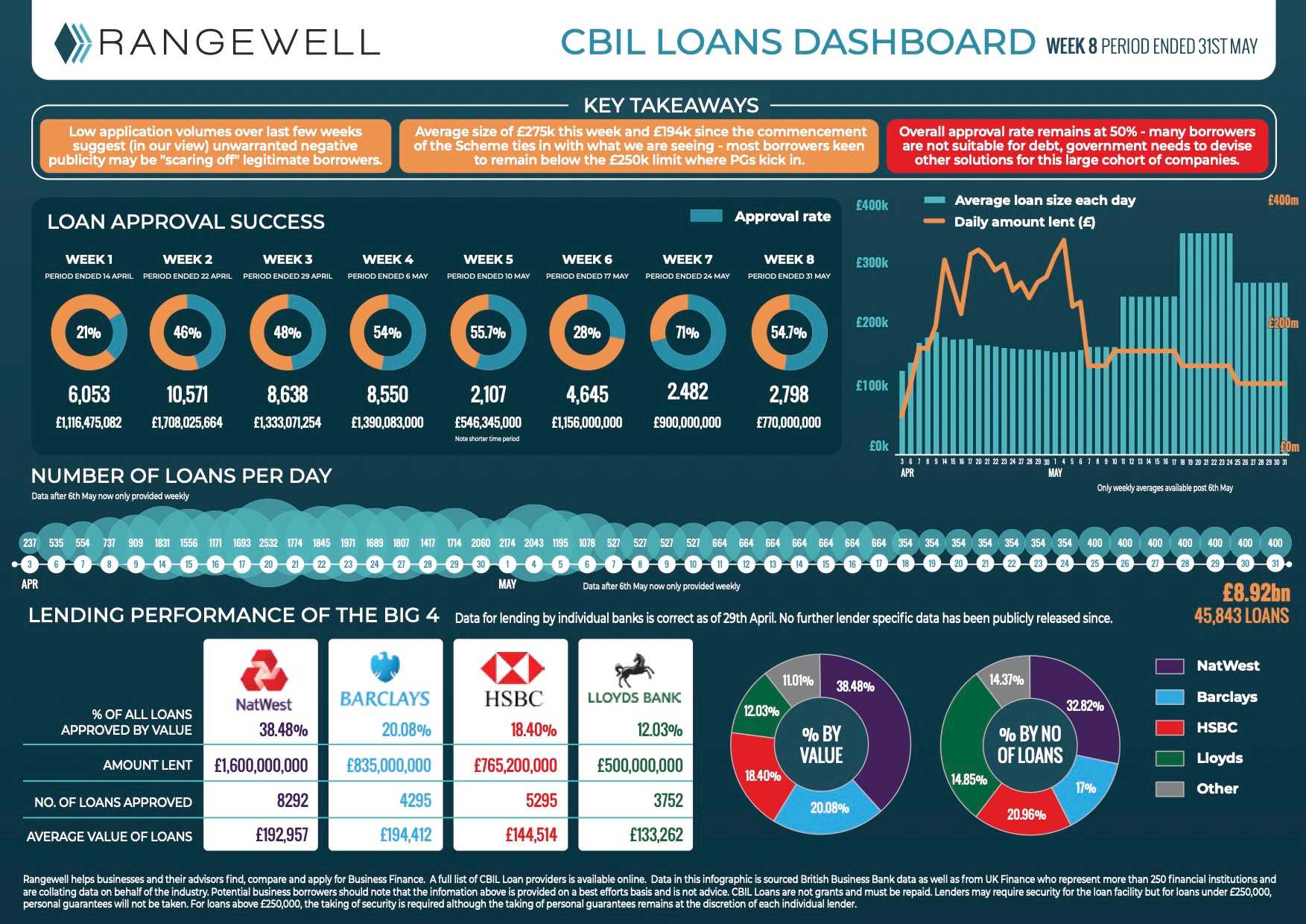

Following the release yesterday of the latest CBIL and Bounce Back Loan data, Rangewell have released their latest Dashboards to help ensure continued scrutiny and understanding of the CBIL and Bounce Back data being published by the Treasury.

- Click here for the CBIL Dashboard in high resolution

- Click here for the Bounce Back Dashboard in high resolution

Key takeaways from the latest data:

CBIL Scheme

- The overall approval rate for the CBIL Scheme remains at 50%.

- Many CBIL applicants are not suitable for debt funding, and both they and the lenders know it

- The government needs to be thinking of other solutions for this large cohort of over 40,000 companies.

- They need a different form of support from the government - Rangewell are suggesting a “Project Spruce” that replicates the forthcoming “Project Birch” being rolled out for larger companies.

- The majority of CBIL applications that have been rejected will be long-standing, credible entities providing employment locally - having failed to receive CBIL funding, many will be facing significant financial difficulties - and many will be just as important to their local economies as the nationally important companies being supported by “Project Birch”.

- The average CBIL loan size of £275,000 this week and £194,000 since the commencement of the Scheme ties in with what Rangewell are seeing - most borrowers keen to remain below the £250k limit where PGs kick in.

- Low volumes of CBIL applications over the last couple of weeks suggest to Rangewell that the early unwarranted negative publicity may be "scaring off" legitimate borrowers from applying to the scheme.

- Although getting very little publicity, the Large CBIL Scheme continues to underperform. The UK's "Mittelstand" is the real backbone of the economy and needs better support than this.

Bounce Back Loan Scheme

- Interestingly the average Bounce Back Loan amount remains at the £30k level - assuming every borrower is applying for the maximum 25% of turnover, it shows the scheme really is helping the smaller end of the SME market.

- Although Bounce Back Loan volumes and loan amounts have fallen significantly again this week, the overall 80% approval rate and the £20bn+ of total lending via the scheme is a huge injection of capital into SMEs.

Our thoughts on the overall performance of CBIL Scheme:

- The overall approval rate for the CBIL Scheme remains at 50%; in reality, this means that over 40,000 businesses have failed to receive the funding they needed - and needed quickly.

- Most of these businesses will be credible, long-standing businesses but not suitable for bank debt. Perhaps this is because of the sector they are in, their stage of development or previous credit issues.

- It is not realistic for the government to ask lenders to breach responsible lending guidelines; as that is what will cause the much-discussed “surge in defaults and would be irresponsible.

- Instead, Rangewell are calling on the government to rapidly replicate and roll-out the forthcoming equity support for larger SMEs that will be provided by “Project Birch” to smaller SMEs.

- Rangewell are suggesting a “Project Spruce” for smaller SMEs, with priority given to those who have failed to receive CBIL funds. In the majority of cases, such companies will have spent considerable time preparing cash flows and business plans - all of which could quickly be reviewed under the new “Project Spruce” scheme and funds deployed rapidly.”

Our thoughts on the overall performance of the Bounce Back scheme:

- Assuming every borrower is applying for the maximum 25% of their turnover, the Bounce Back Loan Scheme is really supporting and helping the cohort of micro and small SMEs and both the lenders and Treasury should be commended for this - to get a scheme of this magnitude up and running so quickly and pumping over £20bn into supporting SMEs is no small feat.

- Rangewell work alongside SMEs every day and the vast majority are hard-working, responsible businesses, providing vital employment and services to their local economies. The headlines being bandied around that half these borrowers have “no intention of paying back the loans” is frankly insulting to small businesses who are facing unprecedented situations and levels of stress whilst trying to keep their businesses afloat.

Rangewell's thoughts on the overall performance of the Large CBIL Loan scheme:

- The Large CBIL Scheme continues to underperform with low application rates and an overall approval rate of just over 30%. The UK's "Mittelstand" are the real backbone of the economy and need much better support than this. The Chancellor needs to urgently work out why this scheme is not performing and see how it can be improved alongside the equity injection plans that have been floated via the much-anticipated “Project Birch” scheme.

Open in high resolution

Open in high resolution Open high resolution

Open high resolution