£150,000 Invoice Finance: Supporting British Engineering

Table of Contents

Engineering is, historically, a key business for the UK. British engineering may have lost some of its prominence on the world stage, but engineering manufacturing - and particularly precision engineering manufacturing - is still a vital industry.

There are small engineering businesses up and down the country engaged in the manufacture of world-leading products. But - like any small business that supplies large customers - they can find they face a serious funding problem.

The challenges you face

Large businesses and organisations who buy from small suppliers are likely to be cash-rich, but will operate to accounting procedures that mean slow payment schedules. In some sectors, terms of 90 or even 120-days are common.

This is a major headache for smaller businesses. Slow payments can easily drive a successful company out of business.

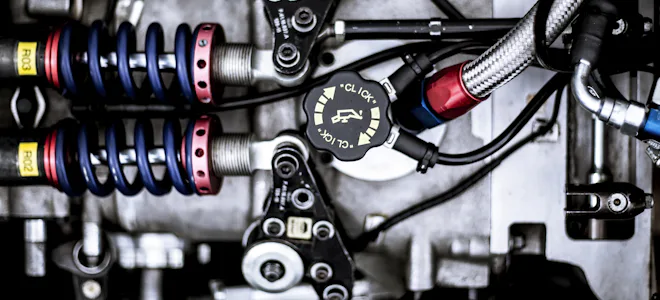

We were recently approached by a small engineering business that produced a small but technically-demanding component for the automotive industry. They had contracts with two major manufacturers and were in talks with a third, but they had a problem - cashflow.

Major automotive manufacturers work on standard 3-month contracts with suppliers. Waiting that long for payment was putting a strain on our client’s business - a strain which would only get worse if they took on another contract.

“You can’t pay out money for supplies, staff and overheads if you don’t have it. We wanted that new contract, but the fact was we were not sure if we could afford to take it on.”

The result is that it may simply not be possible for your small company to supply large customers.

The company found that there was little they could do to persuade their customers to pay faster - the payment terms they worked to are standard practice across the industry. The answer was to seek external funding - but getting the right kind of funding was essential. An established business may be able to arrange several types of finance, but getting the wrong type of funding might answer short-term problems but mean major challenges in the long term.

A solution for manufacturers

We help many of our clients find the most cost-effective answer to this same funding problem with Invoice Finance.

With this type of funding, a funding provider will use your invoices as the security for cash advances. It means that, instead of waiting for a customer to pay, a company can get a cash payment as soon as they dispatch an order and issue an invoice. There are various types of Invoice Finance. All are based on the same principle - a cash advance with the value of the invoice as the security - but the actual arrangement chosen can be tailored to the needs of the business.

Selective Invoice Finance

We saw that the most appropriate solution might be a Selective Invoice Finance arrangement which would allow the business to choose the invoices they submitted as the basis for drawing down funds.

A Selective Invoice arrangement means that you do not need to put all of your invoices through a finance solution. This would be ideal for providing funding based on the new customer, without affecting existing customer relationships.

“Our Selective Invoice Finance arrangement let us have the cash we needed from our new customer - without the wait.”

Our client could get around 85% of the value of each invoice immediately, with the remainder, less the finance provider’s fees, when the customer paid up. So, rather than waiting up to three months for a payment, our client could get an immediate payment as soon as a batch of components was shipped and an invoice sent. It could also mean an immediate end to their cash-flow gap.

We were able to set up a facility with a monthly limit of £150,000, providing ample funding for their current workload - and leaving them in full control of their business.

At Rangewell, we work with you to understand your needs before we recommend a particular type of finance. If you are thinking about an Invoice Finance solution, talk to us. Our service is absolutely free.